The Federal Investigation Agency (FIA) has filed a corruption case against former Federal Board of Revenue (FBR) chairman Shabbar Zaidi, alleging the unauthorised issuance of Rs16 billion in tax refunds to major corporations during and around his tenure.

According to the first information report (FIR), lodged on October 29 by Inspector Muhammad Iqbal of the FIA’s Anti-Corruption Circle Karachi, the case cites violations under Section 5(2) of the Prevention of Corruption Act, 1947 and Section 109 of the Pakistan Penal Code. The investigation is being led by Assistant Director Nand Lal, with the alleged transactions traced to HBL Plaza Branch, II Chundrigar Road, Karachi.

The FIR claims that refunds worth Rs16 billion were issued “without authorisation” to entities that had been clients of Zaidi before his appointment as FBR chairman in May 2019. The listed beneficiaries include Habib Bank Limited (HBL) with Rs10 billion, Engro Corporation Rs2 billion, Standard Chartered Bank (SCB) Rs1.5 billion, Muslim Commercial Bank (MCB) Rs1.5 billion, DG Khan Cement Rs0.5 billion, and Maple Leaf Cement Rs0.7 billion.

The document further alleges that during Zaidi’s tenure—from May 10, 2019, to January 6, 2020—an amount of Rs8.96 billion was released to HBL on September 29, 2019, “in collusion with FBR staff.” The sum was reportedly credited to the Central Depository Company (CDC) account of HBL Treasury Division via income tax bonds valued at Rs100,000 each, totalling 89,645 bonds, with a maturity date of September 29, 2022.

Also Read: The Taj Story , a propaganda to shared history

The refunds in question relate to tax years 2005–07, 2012–14, and 2016–17, spanning both pre- and mid-tenure periods of Zaidi’s time in office.

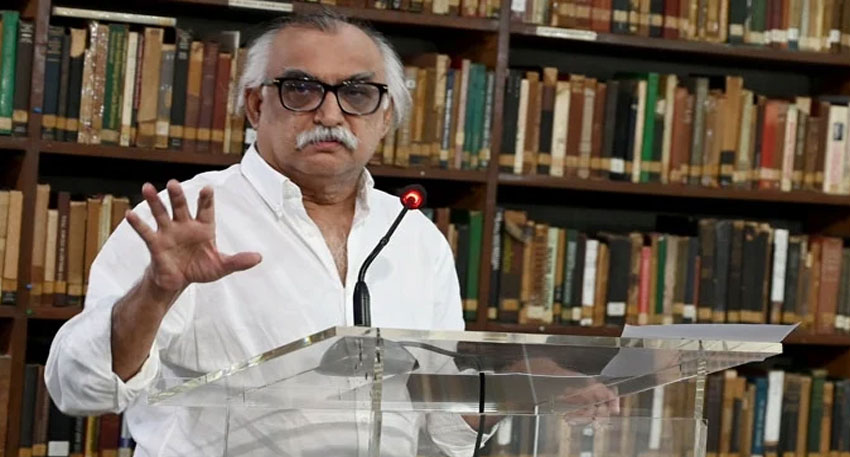

Zaidi, a veteran chartered accountant and former partner at AF Ferguson & Co (PwC Pakistan), served as FBR chairman from May 2019 to January 2020. As of now, the FIA has not confirmed any arrests, and the inquiry remains under investigation.