The Central Directorate of National Savings (CDNS) has introduced a significant policy revision, announcing a 30% withholding tax on profit earned by individuals not listed on the Federal Board of Revenue’s (FBR) Active Taxpayers List. The revised tax structure will take effect from July 1, 2025, and applies to all National Savings Schemes, including Bahbood and Defence Savings Certificates.

Also Read: Honda raises Bike prices after new budget tax

According to the new policy, non-filers will see nearly one-third of their earned profit deducted as withholding tax, while filers will continue to be charged a reduced rate of 15%. For instance, under Bahbood Savings Certificates, a Rs100,000 investment yields a gross annual profit of Rs13,200. After tax deduction, a filer receives Rs11,220, whereas a non-filer receives only Rs9,240 after a 30% deduction.

In addition to the tax update, CDNS has also revised profit structures on its key instruments. Effective from June 27, 2025, Bahbood Savings Certificates will offer a monthly return of Rs1,100 per Rs100,000 invested, reflecting an annual yield of 13.20%. This makes it one of the most attractive options for retired individuals and pensioners, provided they are tax-compliant.

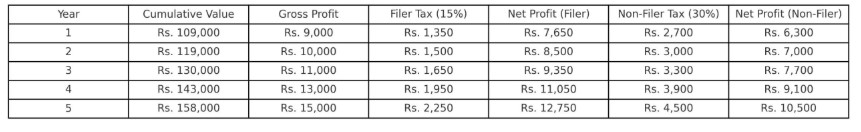

Meanwhile, the revised profit rates for Defence Savings Certificates have also been announced. The scheme now offers a long-term return of 11.19% over a 10-year investment period. Based on new figures, an investment of Rs100,000 would cumulatively grow to Rs109,000 after one year, Rs119,000 after two years, and up to Rs158,000 after five years.

The dual policy revision—higher profit rates and increased tax for non-filers—is aimed at incentivizing tax compliance while ensuring attractive returns for responsible investors. CDNS urges all citizens to ensure their inclusion in the FBR’s Active Taxpayers List to avoid heavy deductions on their savings.