The session commenced with the recitation of the Holy Quran, Naat and the national anthem.

The budget is considered to be crafted to align with the requirements of the International Monetary Fund (IMF) to secure another big loan.

In his budget speech, the finance minister said, “Dear speaker, I think that despite political and economic challenges, our progress on the economic front in the past one year has been impressive.”

The finance minister said the gross revenue receipts have been estimated at Rs17815 billion including FBR's revenue collection of 12970 billion rupees and non-tax revenue 4845 billion rupees. The share of provinces in the federal receipts will be 7438 billion rupees.

The growth rate is expected to be 3.6 percent during the next fiscal year. Inflation is expected to be 12 percent, budget deficit 5.9 percent of GDP and primary surplus will be one percent of GDP. He said that 9775 billion rupees will be paid for interest payment.

He proposed 25 percent increase in the salaries of government employees from Grade-1 to 16 and 20 percent from Grade-17 to 22. He also proposed 15 percent raise in the pension of retired government employees. The minimum wages are being increased from 32,000 to 37,000 rupees.

Also read: Cabinet approves 25pc pay raise for govt employees

He said that the budget of BISP is being enhanced by 27 percent to 593 billion rupees and the recipients under Kafalat program will be enhanced from 9.3 million to 10 million. He said another one million children will be registered in the education stipend program.

There is a proposal to enhance the export refinance scheme from 3.8 billion rupees to 13.8 billion rupees. He said that export credit facility of 539 billion rupees will be provided through State Bank of Pakistan.

He said the Prime Minister has given the direction that this facility is available to at least forty-percent SME sector. He said under the SMEs strategy, the credit for small and medium enterprises will be enhanced from 540 billion rupees to 1100 billion rupees, and the addition of 100 billion rupees will be made in the next fiscal year.

A sum of Rs5 billion have been proposed for the Markup and Risk Sharing Scheme for Farm Mechanization under the Kissan Package announced by Prime Minister Shehbaz Sharif in 2022. He said under the scheme, financing will be available to procure planters, tractors, thrashers, harvesters, and mobile grain dryers.

As regards the construction of water reservoirs, Rs206 billion has been earmarked for water resources in which 45 billion rupees have been set aside for Mohmand dam, 40 billion for Diamer Bhasha dam, 18 billion rupees for Chashma Right Bank Canal and 10 billion rupees for Pat Feeder Canal.

A sum of Rs253 billion has been set aside for the energy sector.

For the IT sector Rs79 billion has been earmarked under which seven billion rupees will be for digitalization and reforms in the FBR.

Over Rs86.9 billion has been proposed in the budget to facilitate the Pakistani diaspora. This amount will be spent on re-imbursement of TT charges, he said.

He said immigration landscape will be digitized to simplify the immigration procedure for facilitation of overseas Pakistanis.

He noted said Mohsin-e-Pakistan award is being introduced for overseas Pakistanis to recognize their extraordinary services for the country.

He shared a substantial amount has been proposed to improve infrastructure and educational facilities in 167 government schools in the federal capital.

He said government is going to introduce a school meal program for physical and mental nourishment of students under which balanced and nutritious food will be provided to students of 200 primary schools of Islamabad.

He said pink buses will be plied from rural to urban areas for female students. Besides, Danish schools are being expanded to Islamabad, Balochistan, Azad Kashmir and Gilgit-Baltistan as per directions of the Prime Minister.

The government is allocating Rs4billion for E-bikes and two billion rupees for energy efficient fans.

The Finance Minister said that the privatization of PIA, Roosevelt Hotel, House Building Finance Corporation and First Women Bank will be accelerated. He said a concrete plan is also being worked out to offer other State Owned enterprises for investment to the private sector.

He said 1400 billion rupees have been earmarked for the PSDP. An additional one hundred billion rupees have been allocated through public-private partnership. He said the development budget will be at the historic level of 1500 billion rupees. He added that 2122 billion rupees will be provided for defence requirement.

He said that 839 billion rupees have been reserved for the expenditure of civil administration. 1014 billion rupees have been set aside for pension expenditure and 1363 billion rupees have allocated as subsidy on electricity, gas and other sectors.

He noted that grants worth 1777 billion rupees have been earmarked for Benazir Income Support Programme, AJK, Gilgit-Baltistan, merged districts, Higher Education Commission, Pakistan Railways and IT sector.

A big volume of development budget manifests the government's resolve to develop infrastructure, transportation, energy and IT sectors as well as address the challenges in the management of water resources.

He said that 824 billion rupees have been proposed to be allocated in the next PSDP for the infrastructure. These includes 253 billion rupees for energy sector, 279 billion rupees for transport and communication sectors, 206 billion rupees for water sector and 86 billion rupees for planning and housing.

Rs280 billion has been earmarked for the social sector as compared to 244 billion rupees of the outgoing fiscal year. 75 billion rupees have been set aside for special areas including AJK and Gilgit-Baltistan, 64 billion rupees for tribal district and 79 billion rupees for Science and IT. Similarly, he said that fifty billion rupees are being set aside for production sector including agriculture.

The Finance Minister said priority will be given to the projects which were approved in accordance with the guidelines of National Economic Council. He said strategic and core projects including water resources, transportation, communication and energy sectors will b given special importance. He said timely completion of foreign funded projects will be ensured in addition to the projects on whom eighty percent resources have already been spent.

He stressed a need for capitalising on a fresh opportunity to revitalise its economy. He said, “Pakistan has another opportunity to improve itself and embark on the path of economic development.” He requested the people of Pakistan not to waste this chance.

He lauded the government’s efforts to address economic challenges and pledged to accelerate development under the leadership of PM Shehbaz.

He noted, “Before presenting the budget, I want to highlight our journey thus far. Under Prime Minister Shehbaz Sharif’s leadership, we have pursued a homegrown agenda that has enabled us to overcome current economic challenges and boost the pace of development.”

He acknowledged the challenges faced by Pakistan’s economy. He lauded the government for securing a crucial nine-month IMF programme in June 2023, which helped Pakistan avoid economic collapse.

He said, “The previous IMF programme was ending, and a new deal was essential to prevent a default. I commend Shehbaz Sharif’s government for their efforts in securing the programme.

Highlighting the significant improvement in economic indicators, he credited the prime minister and his team for their efforts. He said, “Inflation stood at 11.8pc in May, a notable achievement considering the challenges. We’re on the right track, and inflation is likely to decrease further in the coming days.

Regarding the improved economic outlook, he said, “Pakistan’s foreign exchange reserves have been strengthened, and international investors are now seeking opportunities to invest in our economy.”

He supported the SBP’s decision to cut interest rates, citing visible efforts to combat inflation. “The State Bank’s interest rate cut is a significant move, and the efforts to curb inflation are evident. Shehbaz Sharif and his team deserve congratulations for their commendable efforts to turn the economy around,” Aurangzeb noted.

He stressed a need for patience and collective efforts to achieve sustainable economic development, cautioning that progress cannot be accelerated overnight.

Stressing the importance of collaboration and sustained efforts, he said, “There is a need for patience and extreme hard work, combined with homegrown corrective plans. The public must work together with institutions to achieve our economic goals.”

Key points:

• 25% increase in salaries of govt employees of Grade 1 to 16 and 22% of Grade 17 to 22.

• Minimum wage increased from Rs32,000 to Rs37,000.

• 15% increase in pensions.

• Exemption on import of hybrid and luxury electric vehicles.

• Discount on import of solar panel raw materials and components.

• Reforms in the pension system.

• Uniform taxation on mobile phones.

• Rs89b allocated for the IT sector.

Basic structure:

• Budget deficit 6.9 percent of GDP, primary surplus 1 percent of GDP.

• FBR revenue estimated at Rs12,970 billion.

• Federal non-tax revenue target of Rs3,587 billion.

• Allocation of Rs1,400 billion for PSDP.

• Additional Rs100b allocated under Public Private Partnership.

• Rs2,122b allocated for defense needs.

• Rs1,363b as subsidy for electricity, gas and other sectors.

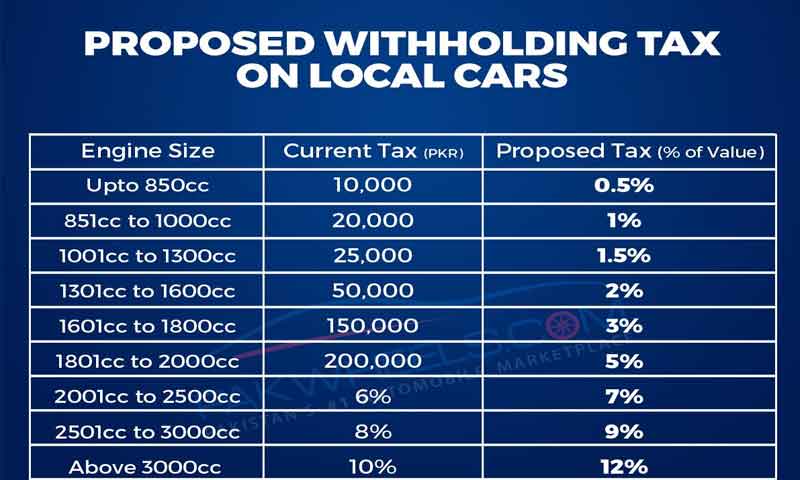

Tax Policy:

• Broadening the tax base and building on digital lines.

• Imposition of higher taxes on high income earners.

• Increased taxation of business transactions for non-filers.

Development Programme:

• Rs1,500b for the largest ever federal public sector development program.

• Rs824b for infrastructure

• Rs280b for social sector

Special measures:

• Improvement of infrastructure of schools and colleges in Islamabad.

• Rs86.9b allocated for promotion of remittances of overseas Pakistanis.

• Comprehensive package proposal for Karachi.

Privatization:

• Accelerated privatization of PIA, Roosevelt Hotel, House Building Finance Corporation, and First Woman Bank.

• Plan to outsource major airports.

Social Security:

• Rs593b for Benazir Income Support Programme.

• Increase from 930,000 to 10 million people in the sponsorship program.