Saleem Mandviwala presided over the meeting. The meeting deliberated over the clause requiring tax auditors and experts to maintain the confidentiality of taxpayers data. Other significant approvals included a ban on the purchase of vehicles, bank accounts, and shares by non-filers.

Additionally, the ban on the buying and selling of property by non-filers and the clause allowing the sharing of data of high-risk individuals with banks were also approved. The meeting also reviewed the Tax Laws Amendment Bill 2024 and approved several of its clauses.

During the meeting, the Chairman of the FBR clarified that under the new laws, individuals will need to prove their financial eligibility before purchasing a vehicle or property. They will also be required to provide details of their income sources in their tax returns.

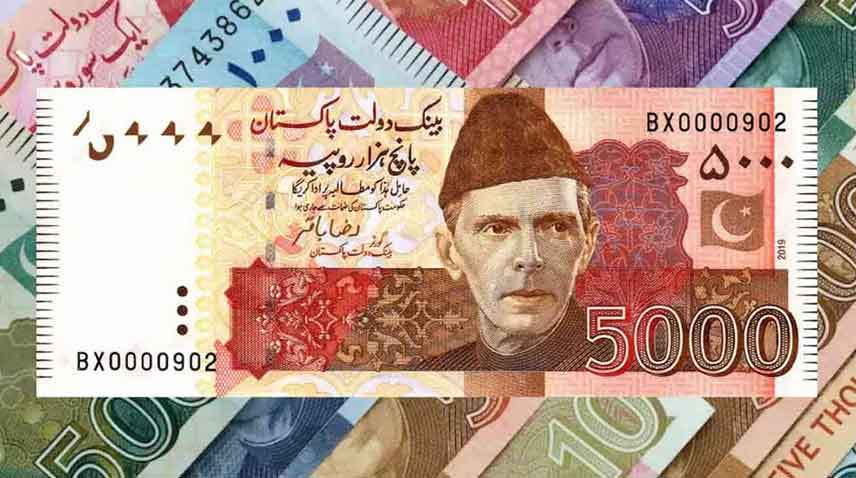

Senator Mohsin Aziz raised an objection, stating that the FBR’s laws are promoting a cash economy. He suggested imposing a ban on the 5,000 rupee note to limit cash transactions.

However, the Chairman of the FBR clarified that 90% of the public will not be affected by this bill, and its primary aim is to curb illegal financial activities.

This proposal could spark a new debate in public and business circles, where cash transactions still constitute a significant part of the economy.