Stunning markets, policymakers balanced the risks of inflation from flood-hit crops against the country’s fragile path to recovery.

This marks the third consecutive meeting where the central bank has chosen stability over change. Since June 2024, SBP slashed the interest rate by a dramatic 1,000 basis points from 22 percent to 11 percent in seven intervals. But since May, the rate has been frozen at the same level.

Despite expectations for further easing, the business community expressed disappointment. Many argue that high borrowing costs continue to choke investment and growth, while others believe holding the rate steady is a necessary shield against inflationary shocks.

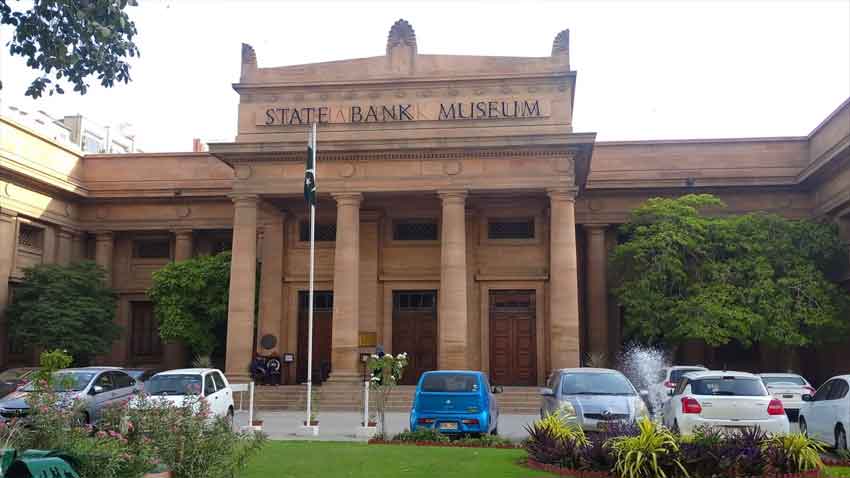

A statement from the State Bank clarified, “The Monetary Policy Committee (MPC) decided to keep the policy rate unchanged at 11 per cent in its meeting today.” This cautious stance has triggered debate across financial circles about whether Pakistan is playing it safe or missing an opportunity for revival.

Inflation remained relatively moderate in both July and August, whereas core inflation continued to decline at a slower pace, the statement noted.

The committee said, “Economic activity — as captured by high-frequency economic indicators, including large-scale manufacturing (LSM) — gained further momentum. However, the near-term macroeconomic outlook has deteriorated slightly in the wake of the ongoing floods.”

“This temporary yet significant flood-induced supply shock, particularly to the crop sector, may push up headline inflation and the current account deficit from earlier expectation in FY26,” it said. It added economic growth was projected to moderate compared to the previous assessment.

Read more: PSX shocks market as 944 points surge pushes 100-index past 155,000 mark

“In view of the evolving macroeconomic outlook and the flood-related uncertainty, the MPC deemed today’s decision as appropriate to maintain price stability.”

The committee observed that the “economy is on a significantly stronger footing to withstand the negative fallout of the ongoing floods” compared to previous major flood events.

“Given the low inflation environment, moderately growing domestic demand and relatively benign global commodity price outlook, the excessive inflationary and external account pressures witnessed after the previous floods are projected to remain in check this time.

It said, “Furthermore, the build-up in external and fiscal buffers over the past two years, which was achieved via a coordinated and prudent monetary and fiscal policy mix, will need to continue to make the economy more resilient to shocks and ensure higher growth on a sustainable basis.”

The statement also said that since the last MPC meeting, SBP’s forex reserves remained stable, despite net debt repayments and a current account deficit; inflation expectations of both consumers and businesses inched up in September in the sentiment surveys jointly conducted by the SBP and the Institute of Business Administration; tax collection by the Federal Bureau of Reserves “fell slightly short of target” during July-August 2025, though it “grew significantly” on a year-on-year basis; and the announcement of revised import tariffs by the US has led to some reduction in global trade uncertainty.

“In view of these developments and outlook, the MPC assessed that the real policy rate remains adequately positive to stabilise inflation within the medium-term target range of five to seven per cent, notwithstanding some expected short-term volatility in inflation out turns.”

It added that inflation in the country rose 4.1pc year-on-year in July before falling to 3pc in August.

“These out turns largely reflected volatility in food and energy prices, whereas core inflation remained on downward trajectory, albeit at a slower pace.”